Flippa is one of the oldest and most well-known marketplaces for buying and selling websites or online businesses, but it also has a reputation for scams. While it’s certainly possible to find hidden gems on Flippa, buyers must use caution. This article covers some of the most common Flippa scams buyers should watch for and how to avoid falling for one.

Is Flippa a Scam?

No. Flippa itself is not a scam. It’s a legitimate and widely used platform for buying and selling websites and online businesses. However, as with any open marketplace (like eBay, for example), there are bound to be some bad actors who try to take advantage of others.

Flippa’s openness is one of the reasons why it’s so popular. Most online business brokers and marketplaces have minimum requirements that prevent sellers from listing many websites and businesses. However, Flippa doesn’t have minimum traffic or revenue requirements, so just about any website or online business can be listed for sale on the platform.

Sellers of small websites and online businesses have few options (Investors Club and BizCanyon are free Flippa alternatives you might want to try), so Flippa attracts many of them. While most sellers and listings are legit, others look to take advantage. As a result, potential buyers must take the necessary precautions to protect themselves from scams.

Read our Flippa review article for more details.

Does Flippa Verify Listings?

Some Flippa alternatives verify the traffic and earnings of the websites they list for sale. Flippa verifies listings priced above $50,000, but not listings below $50,000 (and the vast majority of listings on Flippa are below $50,000). Buyers need to understand how Flippa verifications work.

Flippa verifies the following details for listings priced above $50,000:

- Traffic (verified with Google Analytics)

- Revenue (verified with QuickBooks, Stripe, Shopify, or WooCommerce)

- Primary expenses

Listings below $50,000 go through a simple automated verification process that connects with Google Analytics, but nothing is human-verified unless the seller pays for an upgrade.

Unlike Flippa, Investors Club manually reviews each listing before its published. If you’re looking for a safer marketplace, consider Investors Club.

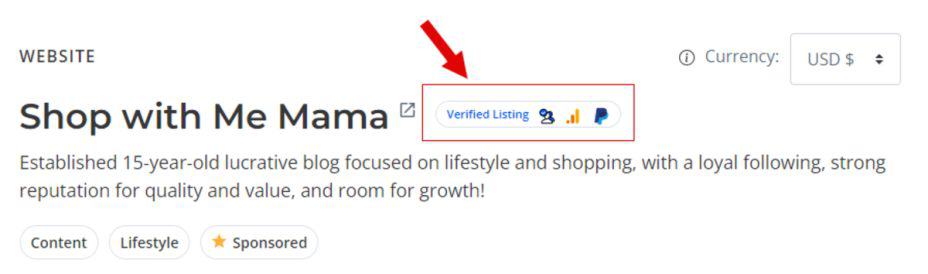

Flippa listings display icons to show verification. For example, the screenshot below shows that the listing has been verified with Google Analytics and PayPal and by Flippa’s vetting team (the user icon with a checkmark indicates human verification).

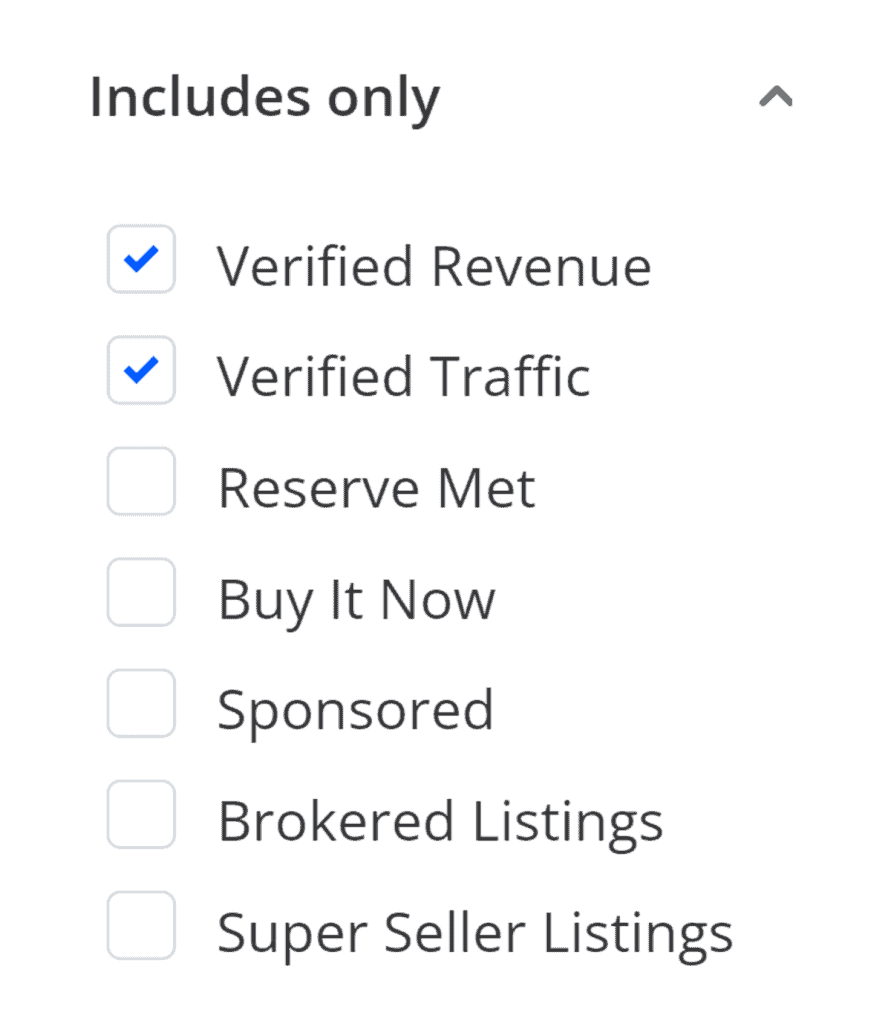

When browsing Flippa listings, you can filter the results to show only verified listings.

It’s essential to recognize that any broker or marketplace’s verification is for fraud prevention. Marketplace verification doesn’t replace the need for in-depth due diligence to determine whether the website or business is a sound investment. Be sure to perform your own due diligence.

Common Flippa Scams and Warning Signs

Now, let’s look at some specific scams and warning signs to watch for. Keep in mind that this is not an exhaustive list, and it’s essential to use your judgment when evaluating each listing and seller.

1. Manipulated Traffic

Flippa verifies traffic by integrating with Google Analytics, but website owners can manipulate the Analytics data. The most common way to do this is by purchasing inexpensive traffic. This low-quality traffic is virtually worthless, but it makes the numbers in Google Analytics look more impressive. Of course, the seller will stop paying for the traffic after the site changes hands, and the traffic will drop. Another approach involves using bots or fake traffic sources to inflate the number of visitors.

Here are some potential warning signs to look out for:

- A sudden spike in traffic without a clear explanation

- A high percentage of “direct” or “referral” traffic in Analytics

- Very brief average time on page (usually less than 10 seconds)

Website traffic that shows up as direct or coming from social media is easier and less expensive to manipulate than organic search traffic. Pay close attention to those traffic sources in Analytics. There should be a clear and logical explanation if there’s been a recent increase in direct or social media traffic. Otherwise, it may be a red flag.

2. Fake Screenshots

Sellers may provide screenshots to serve as proof of revenue. Unfortunately, screenshots are relatively easy to manipulate. Of course, legitimate sellers may also use screenshots to verify revenue, so this isn’t necessarily a red flag. However, you should verify the details in a screenshot to be sure they’re not fake or manipulated.

There are a few ways sellers can manipulate or alter screenshots. First, Photoshop or a similar program can be used to change the details in a way that’s difficult or impossible to notice. Changing numbers in a screenshot (for example, earnings from an affiliate dashboard) is relatively easy with basic Photoshop skills.

Fraudulent sellers can also manipulate screenshots by editing the HTML of a page. Anyone can use Chrome to edit a page’s HTML (see this article) and take a screenshot of the altered page. Sellers may do this to edit revenue displayed in an affiliate, ad, or e-commerce dashboard.

The best way to avoid this Flippa scam is to get access to the dashboard to verify the details. However, sellers may not grant you that access. If not, you can ask the seller to record a video of their dashboard while scrolling and clicking through to different pages within the dashboard. Videos are more challenging to manipulate than screenshots.

Another option is to do a video call with the seller and have them share their screen to show you the dashboards.

You should also add up all of the numbers provided by sellers in screenshots to verify that everything matches. For example, if the seller provides a screenshot of Amazon affiliate earnings, add the revenue from items shipped to ensure it matches the total revenue. Some fraudulent sellers may only manipulate the total. You can tell something is off when the details don’t add up.

3. Fake Financials

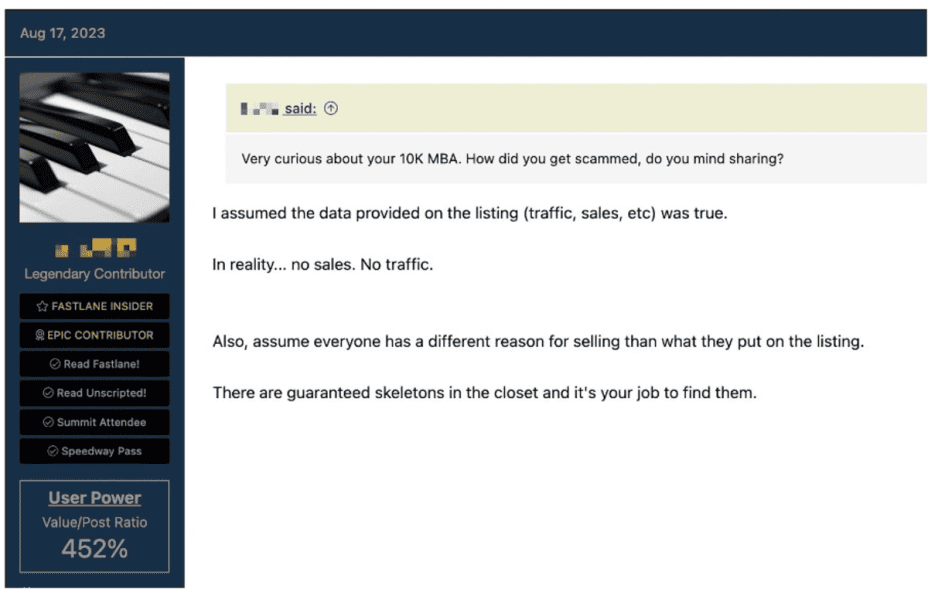

Flippa allows sellers to enter the financial details manually when creating a listing. If the listing isn’t verified, no one checks the details entered by the seller to ensure accuracy. Unfortunately, some buyers assume that the financial information shown on a Flippa listing is verified when, in fact, most listings below $50,000 aren’t verified.

The first step in protecting yourself against this scam is simply understanding that you can’t blindly trust revenue and profit numbers provided by sellers. You should verify earnings with access to dashboards, video recordings of dashboards, or a video call with screen sharing.

4. Amazon Earnings from a Different Site

Many blogs and niche websites make money through Amazon’s affiliate program. Amazon only allows affiliates to have one account, so many site owners use the same affiliate account for multiple websites. Typically, affiliates use different tracking IDs for each website.

Scammers may use screenshots from Amazon’s affiliate dashboard to show earnings generated by another website. When verifying Amazon affiliate earnings, ensure the affiliate ID is visible in the video or shared screen.

5. Plagiarized or Duplicated Content

Sellers may attempt to boost a site’s perceived value by plagiarizing or duplicating content from other websites. The site may look like it has excellent content, but it’s unlikely to stand the test of time if that content was taken from another source (plus, it could leave you vulnerable to copyright infringement claims).

You can use Copyscape to identify these issues. Since most sellers who attempt this scam will not use copied content for 100% of the site, you should check several site pages with Copyscape.

If Copyscape does find matching content on other websites, check the dates the content was added to each site. The site you’re evaluating could have been the one copied, not the one doing the copying.

6. The Asking Price Is Too Low

While not necessarily a scam, listings that have an unusually low asking price (and/or an unusually low multiple) should be approached with caution.

Websites typically sell for 20-40 times their average monthly net profit in most industries. If you see a listing with an asking price of 6-12 times (or less) the average monthly net profit, it may be too good to be true.

A listing that seems to be a bargain will attract buyers, which is what the scammer wants. Inexperienced buyers may overlook the risk because they feel they’re getting a great deal.

If you see a listing with an abnormally low price, verify all the essential details before proceeding with a bid or offer. It’s possible to find good deals on Flippa, but be aware that scammers often use the appearance of a good deal to attract buyers.

7. Lack of Responsiveness from the Seller

If the seller doesn’t answer some of your questions or pushes back on details you need to verify, it could be a sign of a scam. Legitimate sellers are typically eager to communicate with potential buyers and willing to answer any questions buyers have.

If you notice that the seller is slow to respond or avoids answering specific questions, proceed with caution. Sellers hiding or manipulating details are more likely to be evasive.

It’s important to remember that the seller is just as important as the website you’re buying. Even if it’s not a scam, buying from an unresponsive seller will likely be a poor experience. If you don’t trust the seller, don’t pursue the acquisition.

How to Protect Yourself

Here are some specific ways to protect yourself from scams when buying on Flippa.

Verify Everything

The most important thing to do when evaluating a listing is to verify everything for yourself and make an informed decision. Don’t rely solely on the information provided by the seller, as it could be manipulated or inaccurate.

Also, don’t rely on the verification done by Flippa, as it may or may not be sufficient. Ultimately, it’s your responsibility as the potential buyer to perform due diligence. You’re the one that’s taking a financial risk, not Flippa.

Ask Questions

Don’t be afraid to ask questions and communicate with the seller. If you don’t understand something, or if there’s something that seems off, speak up.

Legitimate sellers will answer your questions and provide additional information if needed. Scammers often avoid answering specific questions or become aggressive when asked for more details.

Check the Seller’s Feedback and Ratings

Flippa has a feedback system where buyers and sellers can rate each other. Take the time to browse through the seller’s feedback and ratings to see what others say about their previous transactions.

Sellers with a strong track record on the platform are more likely to be trustworthy. Avoid sellers with bad ratings or reviews. And new sellers with no history on the platform should be carefully evaluated.

Buy with Escrow

Flippa offers an escrow service that holds the buyer’s payment until the website has been successfully transferred. This protects both parties from potential scams or issues with the transfer process.

While Flippa does charge buyers an extra fee to pay with escrow, it helps to protect against fraudulent sellers.

Final Thoughts

Flippa is a legitimate marketplace for buying and selling websites and other digital assets, but scammers exist, as with any open marketplace. The keys to avoiding scams on Flippa start with understanding what has and has not been verified by Flippa and always performing your own due diligence. It’s important to understand that there are many ways for fraudulent sellers to manipulate data. The best way to truly protect yourself is to verify everything.

If you want to use a curated marketplace that reviews each listing, try Investors Club.

Online Business Builder & Content Strategist

Marc has been building websites and online businesses since 2007. He’s built successful businesses in several industries, including web/graphic design, photography, travel, and personal finance. Marc is the founder of Flip My Site, where he writes about buying and selling websites.

Connect with Marc:

Linkedin | Twitter | FlipMySite