Flippa is one of the most well-known marketplaces for buying and selling websites, but it’s not without its flaws. That’s why many users search for a reliable Flippa alternative. In this guide, we’ll explore the best Flippa alternatives, including various websites that are just like Flippa but offer unique features and benefits Flippa does not.

This article will provide you with a list of the best Flippa competitors, including websites like Flippa that cater to different niches, or offer lower fees.

While Flippa offers many services at a range of prices, the size of the market is simply too large for it to meet the needs of every buyer and seller. This article covers some of the issues users have found with Flippa, as well as other options that may be a better fit in certain situations. You’ll find a detailed breakdown of the best Flippa alternatives so you can find the marketplace that best meets your needs.

Why You Might Want a Flippa Alternative

Flippa’s massive audience has made it a popular choice, but no single platform can meet every buyer’s or seller’s needs. For some users, Flippa competitors offer a better fit for their specific goals and challenges.

Low-Quality Listings

While Flippa features many excellent websites and digital businesses, the platform also hosts a fair share of low-quality listings. This can make alternatives like Investors Club or Motion Invest more appealing to those seeking curated options.

Other marketplaces do a better job of filtering their listings to maintain a higher quality.

Too Many Listings

That Flippa offers such a wide range of listings in different stages of development creates opportunities for some buyers and sellers. But it also makes many users feel overwhelmed.

The sheer number of listings makes it difficult for sellers to stand out and attract the attention of potential buyers. The volume also creates a challenge for buyers who have to sift through many listings to find an opportunity that interests them.

Lack of Verification

Flippa has faced some criticism for the amount of fraudulent activity on its site. But to be fair, in recent years they’ve worked to identify and block many scammers. Flippa claims to verify revenue, primary expenses, and traffic numbers for listings priced over $50,000. However, listings below $50,000 are not vetted by Flippa.

Some of the Flippa competitors covered in this article take steps to verify the claims of all listings, not just those priced above $50,000.

That being said, buyers still need to perform due diligence before buying any website or business. The vetting done by marketplaces is helpful, but independent verification is always needed as well.

Fee Structure

How much does flippa charge? This depends on whether you are a buyer or a seller, and what kind of services you want. Flippa’s commission is made up of different parts, some of which are paid only if a sale is successful, while others are charged regardless of whether the sale goes through.

Listing Fee

Flippa charges sellers a listing fee that ranges from $49 to $599, depending on the list price and package chosen. The listing fee applies whether the site or business is successfully sold or not. This is significant because most Flippa competitors do not charge listing fees.

Success Fee

Flippa also collects a percentage of the selling price as a success fee (only applicable if the site or business is sold). The tiered success fees are:

- Under $50,000: 10%

- $50,000 – $99,999: 8%

- $100,000 – $249,999: 6%

For higher-priced listings, the company offers a brokered service called Managed by Flippa. It comes with a monthly fee, as well as a success fee of 3-6% of the selling price.

Overall, Flippa’s fees tend to be on the higher end for a marketplace.

Investors Club charges no listing fee and no success fee, so you can sell your online business at no cost. Learn more about selling on Investors Club.

Buyer Fee

In addition to listing fees and success fees, Flippa also makes money through its First Access program, launched in 2023. First Access is a membership option for buyers that costs $99 per month. The main perk is access to listings 21 days before the public.

The launch of First Access was greeted with plenty of criticism within the community. While the fee is charged to buyers, it has a significant impact on sellers as well. Each listing gets significantly less visibility and exposure since it is unavailable to the public for a full three weeks.

VERY stupid move by Flippa to put deal flow behind a paywall (called First Access).

— Mushfiq Sarker (@mushfiqsarker1) August 9, 2023

Why would I pay to access deals? It's not like the deals are fully vetted either.

They already get paid on a successful sale.

Makes absolutely zero sense.

I love to fish, but sometimes places just turn into bad spots, flood changes topography, man-made obstruction, etc…

— Ronald Skelton (@ronaldskelton) August 9, 2023

Flippa used to look like a good spot, one I knew I'd catch a good one if I just kept trying… now not so much. So we move on.

Additional Features/Services

Flippa’s base service is missing some of the details and features offered by most of its competitors. For example, the non-disclosure agreement (NDA) feature is only included with the two highest-priced packages. Sellers who choose a lower-priced package must pay an additional $199 to collect signed NDAs from potential buyers.

Without a signed NDA, nothing protects a seller from releasing information to competitors or others posing as potential buyers who are simply looking for access to sensitive information. Most of Flippa’s competitors include NDAs at no additional cost.

Also, Flippa does not provide migration assistance or a free escrow service. Some competitors offer one or both of these services.

Auction Approach

Flippa’s market uses an auction format, which some buyers and sellers don’t prefer. Most other website marketplaces use a list price, and buyers can purchase for the list price or submit a lower offer.

The auction approach allows some buyers to come away with a great deal, and some sellers wind up making more if buyers get into a bidding war. It definitely can work well in some situations, but many buyers and sellers prefer a different approach.

Not Ideal for New Buyers and Sellers

Flippa is a great choice for those with experience buying and selling online businesses. Since extra due diligence is needed, those who don’t have experience may take a greater risk using the platform.

The Best Flippa Alternatives: Marketplaces

Now that we’ve covered why Flippa might not be the right fit for everyone, let’s dive into the best Flippa alternatives.

First, we’ll look at marketplaces similar to Flippa.

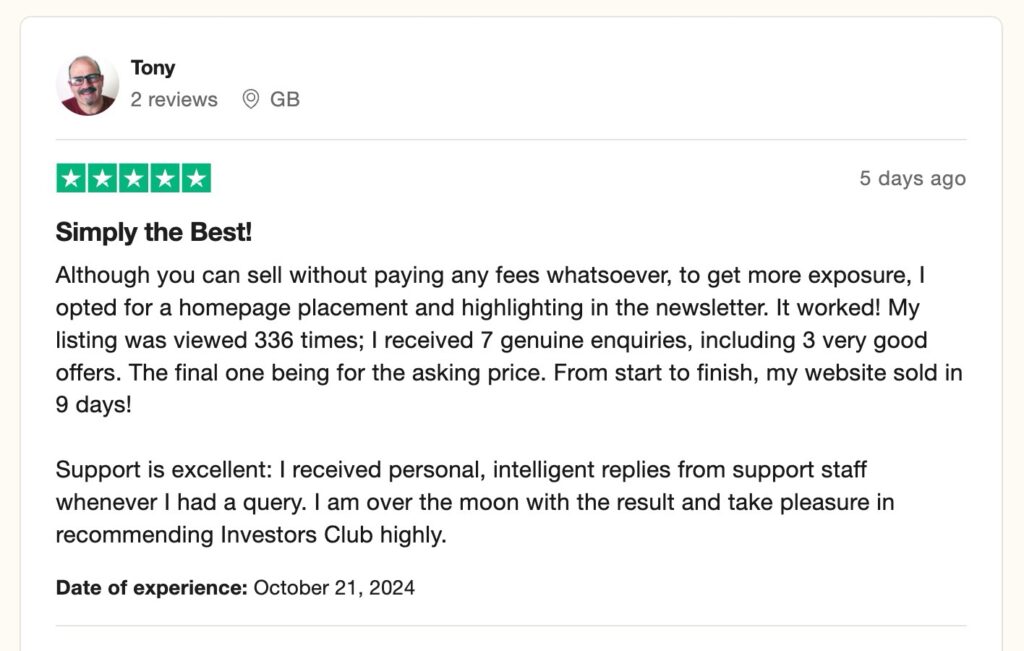

1. Investors Club

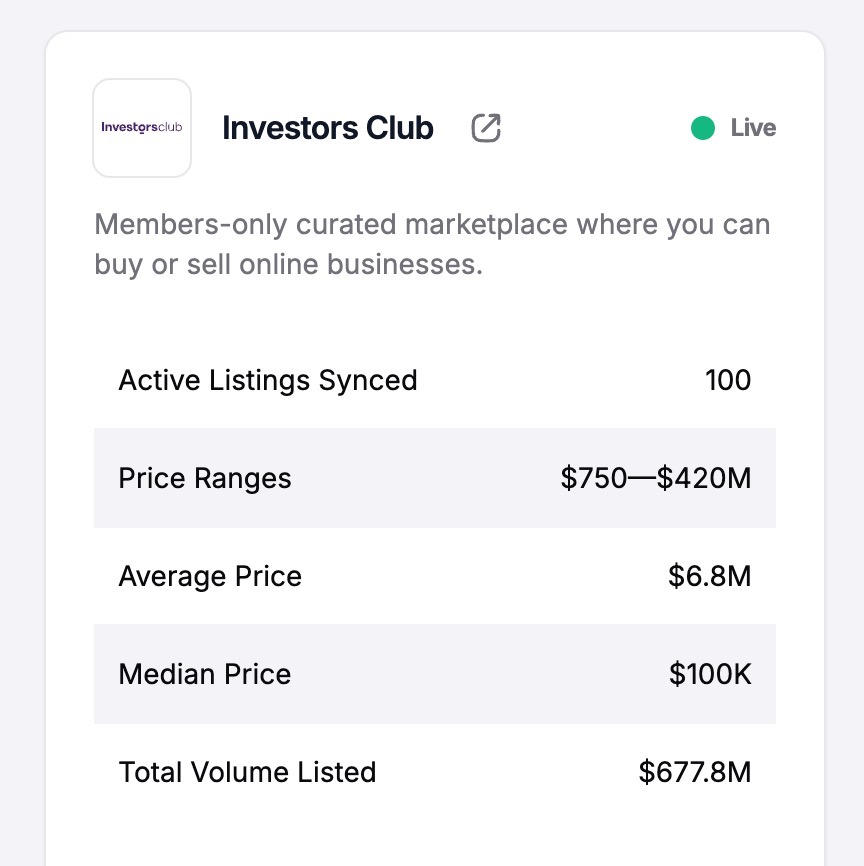

Investors Club is a curated marketplace for buying and selling different online businesses (Amazon businesses, e-commerce businesses including Amazon FBA, dropshipping, blogs, SaaS, etc.)

Unlike Flippa, Investors Club takes a quality over quantity approach. More than half of the listing submissions are rejected, and buyers and sellers both benefit from the enhanced quality of the marketplace.

Unlike most other marketplaces, Investors Club has an excellent selection of businesses priced below $100,000, with quite a few businesses under $5000. They also have listings above $100,000, and even some that exceed $1 million.

Investors Club is an active marketplace with enough listings to interest buyers, but not so many that buyers will feel overwhelmed.

Investors Club offers helpful services to buyers and sellers. Support is available throughout the process, from listing to close.

Investors Club Fees

Investors Club does not charge a listing fee, or a success fee . While many marketplaces and brokers charge 10-20% success fees, Investors Club allows sellers to keep more of their hard-earned money.

Investors Club offers some paid marketing and privacy add-ons to their sellers, but those are completely optional. Anyone can sell their online business on Investors Club without paying a penny.

Investors Club uses a unique membership model for buyers. Both buyers and sellers can buy and sell businesses without paying a single dollar. Optionally, buyers can upgrade to a premium membership that provides additional perks like earlier access to listings, access to additional information about businesses listed, and priority support.

The cost of the premium membership is $59 per month or $390 per year.

Pros:

- No fees

- Curated listings

- Plenty of listings without becoming overwhelming

- Many listings are priced below $100,000

Cons:

- Mainly content and e-commerce websites

- Fewer listings in the 7-8 figure range

| Flippa | Investors Club | |

| Listing Fee | $49-$599 | $0 |

| Success Fee | 6-10% | $0 |

| Verified listings under $50k | No | Yes |

| Due diligence reports | No | Yes (for premium members) |

For more details, please read Flippa vs. Investors Club.

2. Motion Invest

Motion Invest is an excellent Flippa alternative, offering a curated selection of smaller content sites that are perfect for first-time buyers.

While many of the marketplaces on this list work with a variety of online business models, Motion Invest focuses exclusively on content sites like blogs and niche sites. Update October 2024: you can buy and sell Youtube Channels.

This Flippa alternative also stands out by offering many lower-priced listings and starter sites. This section of the market is overlooked by many brokers and marketplaces, but you can find an excellent selection of websites below $30,000 at Motion Invest.

You will find some listings above $100,000 at Motion Invest, but most are in the 4-5 figure range.

Even though they focus on smaller deals, Motion Invest verifies the traffic (via Google Analytics) and earnings for each listing. This makes it a good alternative to Flippa for smaller deals.

Motion Invest Fees

The only fee charged by Motion Invest is the success fee that sellers pay for a completed sale. The commission percentage depends on the selling price, and the tiers are:

- Under $20,000: 20%

- $20,000 – $50,000: 15%

- $50,000 – $100,000: 10%

- $100,000 – $500,000: 7%

- Over $500,000: 5%

Pros:

- Good selection of listings below $50,000

- Every listing is verified and vetted

- Free migration assistance

- Free escrow service

Cons:

- Only for content-based websites and YouTube accounts

- Very few listings above $100,000

- Fees on lower-priced listings are high

For more details, please read Flippa vs. Motion Invest and Motion Invest Review.

3. Acquire.com

Acquire.com (formerly MicroAcquire) is a marketplace for buying and selling startups. It features a large, active community with a high volume of listings.

About half of the listings on Acquire.com are SaaS businesses, but you’ll also find marketplaces, e-commerce websites, content businesses, agencies, mobile apps, and more.

Acquire.com connects with QuickBooks, Stripe, PayPal, and other platforms to verify revenue. It also connects with Google Analytics for traffic verification. It’s not a full-service brokerage, but the Acquire.com team does help sellers with details like creating the listing.

Sellers can also communicate with a potential buyer easily through the platform.

Acquire.com Fees

Acquire.com does not charge a listing fee. The success fee is a flat 4% of the selling price (no tiers).

Like Investors Club, Acquire.com uses a membership model for buyers. A free plan is available, but the functionality is extremely limited. Buyers with a free membership can see listing details, but upgrading is necessary to get in touch with the seller and move forward.

Upgraded membership costs $390 per year for the premium plan or $780 per year for the platinum plan.

Pros:

- Large audience

- Many listings in all price ranges

- Sellers can get help creating listings

- Free legal documents

- Free escrow service

- Low fees

Cons:

- Better for SaaS than some other business models

- Many listings are priced at very high multiples

- The high number of listings can feel overwhelming

- Buyers have to pay membership fees to contact sellers

4. BuySellEmpire

BuySellEmpire is an online marketplace and Flippa alternative for content websites, e-commerce, Amazon FBA, SaaS, and other online business models.

To qualify, businesses must:

- Earn at least $1,500 per month

- Have 12 months of verifiable website traffic and earnings

- Publish content only in English

BuySellEmpire provides some services to vet both buyers and sellers, but it’s not a full-service brokerage. Buyers and sellers will communicate directly and negotiate without an intermediary.

Although BuySellEmpire is active, it has relatively few listings compared to some of the marketplaces covered in this article (12 active listings at the time of this article).

Most of the listings at BuySellEmpire are priced between $100,000-$500,000, with some outliers.

BuySellEmpire Fees

BuySellEmpire charges buyers nothing. Sellers pay only a success fee (no listing fees). The success fee is tiered, based on the selling price:

- Under $500,000: 7%

- $500,000 – $5.000,000: 6%

- $5,000,000 – $10,000,000: 5%

- $10,000,000+: 4%

Pros:

- Low fees

- No exclusivity agreement

Cons:

- Fewer listings than the other marketplaces on this list

- Very few listings below $100,000

Other Flippa Competitors: Full-Service Brokers

The brokers in this section provide more hands-on assistance compared to a marketplace. Broker fees are generally higher than marketplace fees, but the broker handles details like preliminary communication with potential buyers, help selling the site, and negotiation.

5. Empire Flippers

Empire Flippers began as AdSense Flippers in 2010 and was rebranded to Empire Flippers in 2012. With more than a decade of experience, Empire Flippers is one of the top competitor to Flippa.

The biggest difference between the Flippa marketplace and Empire Flippers involves the range of listing prices. Most of the listings at Empire Flippers are between $100,000 – $999,999, with some listings over $1 million.

Empire Flippers requires a minimum average of $2,000 of monthly net profit over the past 12 months, so smaller websites and businesses are not eligible.

They sell a wide variety of online businesses, including content, e-commerce, lead gen, SaaS, apps, info products, and more.

Like Investors Club, Empire Flippers also verifies the traffic and revenue of each listing before it’s published on the marketplace.

Empire Flippers Fees

The only fees imposed by Empire Flippers are success fees paid by the seller (no listing fees). The success fee is tiered at:

- Under $700,000: 15%

- The value of the business between $700,000 to $5,000,000: 8%

- The value of the business above $5,000,000: 2.5%

Although Empire Flippers uses multiple tiers, its approach is different from the others listed above. For example, the fee for a $1,000,000 sale is $129,000 (15% of $700,000 plus 8% of the additional $300,000 that falls into a different bucket).

Pros:

- Large audience of buyers

- Active marketplace

- Vetted listings

- Escrow service and migration assistance

Cons:

- High fees

- Almost no listings below $100,000

6. Quiet Light Brokerage

Quiet Light is one of the most popular online business brokers. Sellers receive professional assistance through the entire process from an individual broker who has entrepreneurial experience. They help with everything from valuation to closing.

The listings at Quiet Light feature a wide variety of business models, including e-commerce, Amazon FBA, content, SaaS, and more.

Like many brokers, Quiet Light does not list low-priced deals. Most of the listings are in the 6-7 figure range.

Quiet Light vets each listing and maintains a high standard for quality. You won’t find a huge number of listings on their site (38 active listings at the time of this article), but you will find quality online businesses.

Quiet Light Fees

Quiet Light does not charge a listing fee. The only fees are success fees, which are based on the selling price. They do not list their fees publicly, but the fee percentage goes down as the listing selling price goes up.

Pros:

- Excellent selection of 6-7 figure online businesses

- Large audience of qualified buyers

- Established reputation and track record

Cons:

- Not suitable for smaller businesses

- High fees

7. FE International

FE International is another full-service brokerage that sells just about any type of online business. Like Quiet Light, they have an established reputation in the industry.

They also take a quality over quantity approach, and most of their listings are 7-8 figures or above. Few details of the listings are visible to the public. Prospective buyers must schedule a call to request more information.

FE International carefully vets each business owner and business before listing.

FE International Fees

FE International does not charge sellers a listing fee. The only fee sellers pay is a success fee if the business is sold. The success fees are not listed publicly, but they reportedly start at 15% and go down for larger deals.

Pros:

- Quality over quantity approach

- Large audience of qualified buyers

- Full service brokerage

- Excellent track record

Cons:

- Not suitable for smaller businesses

- High fees

FAQ

Is Flippa a legit site?

Yes, Flippa is legit. However, buyers and sellers should be cautious and perform their own due diligence. Listings priced below $50,000 in particular are not vetted by Flippa.

Is it safe to sell on Flippa?

The Flippa platform itself is not dangerous. However, sellers should take the necessary precautions, including getting a signed contract or agreement, using an escrow service, and having a non-disclosure agreement.

Do people make money on Flippa?

Yes, people do make money on Flippa. Businesses are sold on Flippa every day. Many entrepreneurs also make money by finding quality deals, improving them, and increasing profitability and valuations.

Does Flippa take a commission?

Yes. Flippa charges sellers a listing fee ($49 – $599) and a success fee. The success fee is 10% of the sale price for deals below $50,000, 8% for deals from $50,000-$99,999, and 6% for deals from $100,000-$249,999. They have a more comprehensive Managed by Flippa service for listings over $250,000.

How long does it take to sell on Flippa?

The timeline varies from one deal to the next, depending on the details. Some listings sell quickly, some take a long time, and others never sell. The listing price, the reserve price, and the seller’s willingness (or lack thereof) can all affect the timeline. Motivated sellers who are flexible are more likely to experience a quick sale.

How to Choose the Right Flippa Alternative

Choosing the best Flippa alternative depends on your goals as a buyer or seller.

If you’re looking for curated, high-value listings, platforms like Investors Club and Empire Flippers may be ideal. For smaller content sites, Motion Invest could be a better fit. Think about factors like fees, vetting processes, and the types of businesses you’re interested in before making your decision.

Final Thoughts on Flippa Alternatives

Flippa is one of the leading marketplaces for buying and selling websites, online businesses, and domain names. However, there are some downsides to consider, as well as excellent alternatives.

Take some time to explore the options covered in this article to find the one that best meets your needs.

If you’re interested in selling your website or online business, please try the Investors Club valuation tool to see what your business is worth. If you’re looking to buy an established website or online business, create a free Investors Club account to get access.

Online Business Builder & Content Strategist

Marc has been building websites and online businesses since 2007. He’s built successful businesses in several industries, including web/graphic design, photography, travel, and personal finance. Marc is the founder of Flip My Site, where he writes about buying and selling websites.

Connect with Marc:

Linkedin | Twitter | FlipMySite