One of the hardest decisions you’ll face as a website owner is not when to buy and sell, but where.

While buying and selling websites can be a lucrative investment opportunity, high broker fees and hidden costs can quickly eat into your bottom line.

Buyers and sellers seeking alternatives to Flippa have a range of choices, with Investors Club frequently mentioned as a noteworthy option. This article will compare Investors Club with Flippa, outlining key differences and guiding you on when to choose one over the other

But first, a little background.

Considered the OG broker and the first marketplace for trading websites, Flippa (read Flippa review here) “facilitates the meeting of buyers and sellers”. Founded in 2009 and headquartered in Melbourne, Australia, and Austin, Texas, it boasts more than 300,000+ buyers and has handled over $400 million in sales since its inception.

Launching in 2020, Investors Club (IC) is the new kid on the block — but what it lacks in age it more than makes up for with experience.

IC is the brainchild of serial website builder Andrej Ilisin who has successfully grown two businesses to 7-figures respectively and built and flipped many websites in the process.

Founded to fill the gap in the market for a straight-forward, customer-focused, low-cost online marketplace, members benefit from a wealth of global experience.

With a fully remote team, the lack of fancy corporate office spaces keeps costs down, enabling Investors Club to pass on the savings, offering the lowest seller’s fees in the industry (no listing fee and no success fee).

Here’s how the two compare.

Listing Category Options

Investors Club lists profit-generating online businesses of all kinds. You’ll find a lot of content websites and e-commerce businesses here, but other types of online businesses are also welcome. Business must average at least $30/month for 12 months to qualify for listing.

The Investors Club marketplace allows buyers to filter listings based on several different factors to quickly find exactly what they’re looking for.

Flippa also offers a wider variety of investment options:

- Websites

- Domains

- Apps

- Starter sites/templates

Listings are ranked using the platform’s own system which considers the information supplied by the seller alongside the listing’s data integrations.

With the option to pay extra to boost your listing and a lack of seller verification, buyers have to filter through an overwhelming number of sites to find the good ones and avoid the scam sites (more on this later).

Winner: Tie. Flippa offers a wide variety of options, which can make it challenging for buyers to find good deals and for sellers to stand out.

Fees

One of the biggest deciding factors between online website marketplaces and brokers is the fees — hidden or otherwise.

Flippa charges a listing fee that must be paid upfront and is not refundable if the business doesn’t sell. The listing fee ranges from $29 – $699, depending on the asset’s value and the package chosen by the seller. Flippa also charges a success fee if the business successfully sells. The success fee is a percentage of the selling price and varies from 3-10%.

Flippa also offers sellers a number of optional upgrades, like $199 for a confidential listing. Their fee structure is quite complex compared to most other marketplaces. We have an entire article dedicated to Flippa fees if you want all the details. Here is a short version:

Listing Fees: $29 to $699, depending on the selected package.

Success Fees: 10% for sales up to 50K, 9% for sales $50,000 – $99,999, 8% for sales $100,000 – $249,999. Flippa also has a “brokered listings” that cost $999 for a nine-month term, plus a success fee from 3% to 8%.

Escrow Fees: price varies; from 0.89% to 3.25% of the selling price. Buyers also pay an additional 2.9% fee if using a debit or credit card.

Additional Fees (Optional): price varies from $65 to thousands. A few examples:

- Confidential listing with NDAs: $199

- Legal document templates: $199

- Promotional upgrades: $65 – $295

- Due Diligence Report: starting at $1000

Investors Club on the other hand keeps things simple.

We don’t charge listing fees or success fees to sellers. We do offer a few optional marketing packages to get more exposure for a listing, but this is completely optional. Buyers can choose a Free membership or upgrade to a Premium membership for several added benefits like:

- Immediate access to new listings (5 days before everyone else)

- Revenue and traffic insights: graphs, downloads, reports

- Premium-only business listings

- Ad-free browsing experience

- Weekly deal flow notifications

The Premium membership costs $59/month or $390/year.

Winner: Investors Club for the simple, no-cost approach.

Buying

Both Flippa and Investors Club offer Free and Premium options for buyers, but there are some significant differences. Flippa’s First Access program provides Premium buyers with access a full 21 days before everyone else. Investors Club Premium members get access to new listings five days before everyone else.

We feel that 21 days is such a long time that it hurts both buyers and sellers. Buyers with a Free account are at a significant disadvantage since most of the best deals will be scooped up during the exclusive access period. It also hurts sellers because the decreased exposure for the first 21 days can decrease demand. Sellers may feel pressure to accept low offers shortly after listing because most potential buyers won’t even see the listing for three weeks.

The five-day head start of Premium members at Investors Club provides a sufficient benefit without putting sellers and Free members at a major disadvantage.

Additionally, Investors Club provides Premium members with free due diligence reports on finances, content, and traffic. While it’s still imperative for buyers to complete their own due diligence, these reports can be excellent time savers.

And finally, the browsing experience is much different at Flippa and Investors Club because of the number of active listings. Flippa accepts almost any listing, so there are thousands of listings at any time. While the variety is nice for buyers, it can be overwhelming to browse the listings.

Investors Club is a curated marketplace with far fewer active listings. We reject listing submissions that don’t meet our criteria, which helps to keep the quality of listings higher. Every online business listed for sale at Investors Club must have at least 12 months history and earn at least $30/month.

Winner: Investors Club for the more manageable browsing experience, due diligence reports, and shorter period exclusively for Premium members.

Selling

Flippa sellers benefit from a buyer pool of $1.2 billion and the flexibility to offer auction or fixed-priced listings.

However, there are some downsides to selling on Flippa. First, it’s difficult for sellers to stand out from thousands of other listings. Flippa’s extensive buyer pool is enticing, but most potential buyers will never see your listing.

Second, the selling fees (which we’ve already discussed) are significantly higher at Flippa. Investors Club offers a fee-free selling experience with no listing fee and no success fee. As a seller, you’re able to keep more of your hard-earned money by not paying fees.

Third, Flippa has a reputation for scams. Of course, Flippa itself is completely legit, but as the largest and most popular marketplace, it attracts some bad actors.

Winner: Investors Club for allowing sellers to stand out, save money on fees, and avoid scams.

Valuation Tools

Sellers can access Investors Club’s free valuation tool before they sign up to the platform and get a commitment-free valuation of their site. The process is quick and easy, providing a recommended valuation range in just a few minutes or less.

Flippa also offers an online valuation service but it’s limited to a set of predetermined questions. Only taking into account data from the previous month, it’s unlikely to provide a super accurate valuation vs other more detailed tools.

Winner: Investors Club for its free detailed valuation tool.

Due Diligence

Flippa currently provides three due diligence packages: the red flag report, standard report, and enhanced report. These are optional and available to buyers for an additional fee (with $1,500 for the cheapest report).

Flippa states that it is the buyer’s responsibility to vet claims made by sellers and sets out a recommendation for due diligence methods that should be performed before a sale.

Buyers can take advantage of their report service or use services like Centurica’s for due diligence.

However, for those unwilling or unable to pay these extra costs, there’s a lot of work to be done before you can even compare potential investments.

With a bad history of scam sites and fake data, there’s a lot of hay to sort through to find that prized needle.

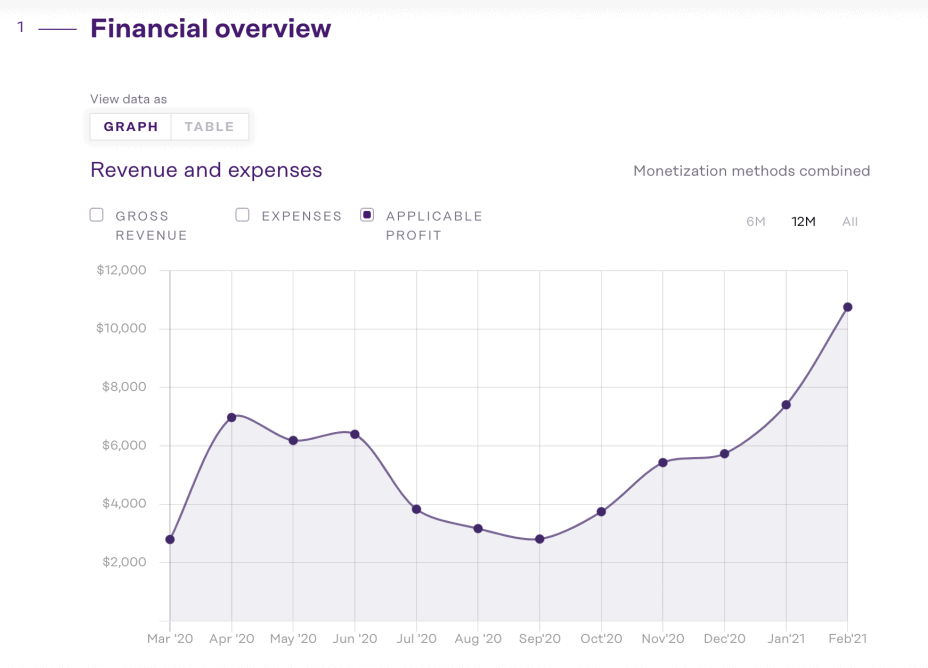

Investors Club Premium members can access helpful graphs and reports that make due diligence easier.

Buyers can get a complete look at each business and access to the information required to set them up for success without having to buy additional reports on each business.

Winner: Investors Club for detailed due diligence reports.

Site Migration Service and the Legal “Stuff”

Flippa states on its website that “Flippa does not take part in the transfer of ownership or delivery of assets and inclusions within a sale”. Therefore it falls on both the buyer and the seller to ensure they are capable of transferring everything and can do so without disrupting the website.

Similarly, while they offer an integrated offers platform, Flippa only provides Contract of Sale templates and recommends that third-party legal advice is sought before finalizing a sale.

Investors Club’s does offer complete with done-for-you legal documents and an internal migration service that handles all site transfers, but this is only available on the “full service” model.

Winner: No winner.

Customer Service

Both sites offer detailed FAQ sections and blogs full of useful resources for both buyers and sellers.

However while Investors Club offers a responsive, dedicated customer support service, Flippa offers 24/7 support giving them the edge for night-owl investors. That being said, TrustPilot reviews say that buyers and sellers often had to wait as long as a week to hear back from Flippa’s support team.

Winner: No winner.

Summary

Investors Club offers no fees, curated listings, and expert analysis. Explore the marketplace to see what business opportunities are waiting for you and join the thousands of investors choosing Investors Club today.

Content Marketing Specialist

Hannah is a content marketing specialist at Investors Club and a freelance copywriter. When she’s not busy behind the keyboard, you’ll find her baking her signature salted caramel brownies or trying to sink that elusive hole-in-one.

Connect with Hannah:

Linkedin